Individuals who want to file a Chapter 7 bankruptcy to get out of debt, must pass a means test. The means test considers an individual’s income, expenses, and family size to determine whether the individual has enough disposable income to repay their debts. Congress enacted the means test to stop individuals who could repay their debts from using the bankruptcy process to eliminate their debts. Congress didn’t think it is fair to allow individuals who had the means to pay some of their debts, and not pay their creditors back. Thus, individuals that have enough disposable income to pay back some or all their debts will need to enter a Chapter 13 repayment plan. Below we will discuss how the means test works.

How Does the Chapter 7 Means Test Work?

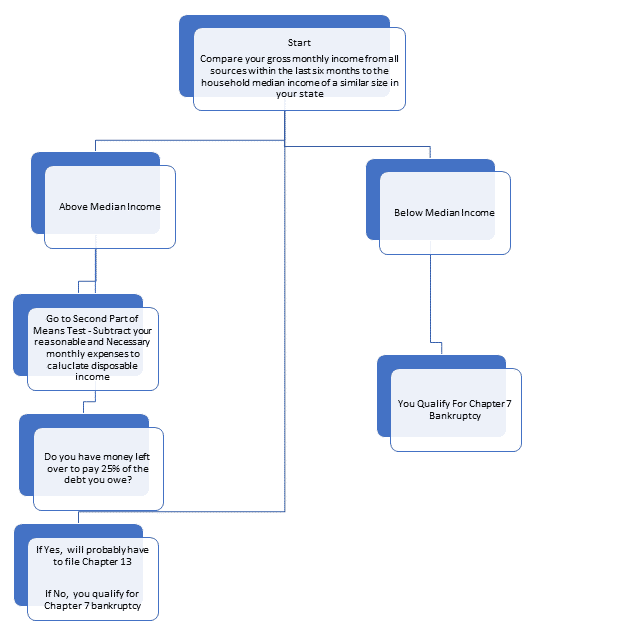

For individuals who have never seen the means test before it can be confusing. The means test ultimately determines what chapter of bankruptcy an individual can file. The means test has two parts, which are designed to calculate whether an individual has money that could be used to pay some debt back.

Generally, all individuals with consumer debt must pass the means test to qualify for a Chapter 7 bankruptcy. However, certain individuals can be exempt from the Means Test if they fall into one of these categories:

The First Part of the Means Test

The first part of the means test determines whether an individual’s household income is below the household median income in the state they live.

The Documents Needed

To calculate this figure, the individual will need to gather documentation showing all their income over the past six months. The individual will need documents from the last 6 months showing what they were paid from the following sources:

Further, individuals will want to gather information about their monthly expenses. Individuals can make a chart showing how much they spend on their expenses every month. People thinking about filing bankruptcy will only be allowed to deduct “reasonable” expenses on the means test. Items such as car payments, rent, mortgage payments, rent groceries, and medical expenses are deemed reasonable. Individuals should remember to include expenses that are done once a year (ie. Car inspection fees etc.)

The Means Test Figures

Individuals should note that Means Test figures change periodically. Individuals can use this chart to determine the median income in their state for cases filed after May 1, 2020. People considering bankruptcy should note that since the means test calculations are based on an average of an individual’s last six months of income, if they don’t qualify now they may qualify at a different time. For example, individuals that have seasonal work may get paid less during certain times of the year. Thus, maybe filing when there is no work may be a better time. Further, since the means test also considers an individual’s family size if someone is expecting or adding to their family size, they may end up qualifying down the line.

Passing the Means Test

Individuals who are below the median income in their state, pass the means test, and can file Chapter 7 bankruptcy. Passing the Chapter 7 means test means the individual can file bankruptcy and get their credit card debt, medical debt and personal loan debt eliminated.

Even though an individual passes the Chapter 7 means test, it does not mean that Chapter 7 bankruptcy is the right option. Individuals with assets may need to consider filing Chapter 13 bankruptcy to ensure their property is safe.

Failing the Means Test

Individuals who don’t pass the first part of the means test will need to go to the second part of the means test. If the individual doesn’t pass the second part of the means test they will need to file a Chapter 13 bankruptcy instead.

Unlike the first part of the means test that only looks at an individual’s last six months of income, the second part of the means test considers an individual’s monthly expenses. Some of these monthly expenses include:

People considering bankruptcy should note that student loan payments and credit card payments cannot be deducted on the means test.

What Should You Do If You Fail Both Parts of the Means Test?

Individuals who fail both parts of the means test, unfortunately, can’t file a Chapter 7 bankruptcy. There is no way to appeal the means test if an individual does not qualify. Individuals who don’t pass the Means Test may need to file a Chapter 13 bankruptcy which allows individuals to use their monthly disposable income to pay back a portion of their debts.

Before going directly to a Chapter 13 bankruptcy, individuals should speak with a bankruptcy lawyer. Many times, people considering bankruptcy often forget expenses that can be deducted on the means test. A bankruptcy lawyer can go over an individual’s financial situation and determine if there may be a “better” time to file. This can be true for people who don’t make the same amount all year round. Maybe the individual makes the most income during the Christmas season so if they wait to file, they may qualify in July when the individual’s Christmas bonus wouldn’t be factored into the past six-month average means test period.

Bankruptcy lawyers can also suggest certain expenses that may be beneficial to help qualify. For example, maybe if you were thinking about getting a car in the near future an attorney might advise you to get the car now to qualify. Or an attorney may want you to think about getting health insurance if you don’t already have it?

The means test can seem quite confusing to most people. Individuals can do a quick online search to find “free means test calculators.” These calculators can be used to help individuals see if they qualify for a Chapter 7 bankruptcy. If an individual does decide to take advantage of these free online tools they should make sure that the calculator is up to date and specific to the jurisdiction they live in. Means Test numbers change quite frequently and it is important that individuals use the most up to date tools.

Passing the Means Test is the most important part of a Chapter 7 bankruptcy. Thus, making sure all calculations are done correctly is vital. Individuals who don’t pass the test and file their case run the risk of getting their case dismissed or converted to a Chapter 13. Individuals considering filing bankruptcy should sit down and speak with a professional about whether they qualify for Chapter 7 under the means test.