Many individuals considering bankruptcy to help them get out of debt often assume if they file bankruptcy their home will be taken away. In some cases, this may be true, however, this is not always the case. Individuals who are considering bankruptcy can either file a Chapter 7 bankruptcy or Chapter 13 bankruptcy. In a Chapter 7 bankruptcy individuals who want to keep their home will need to be up to date on their mortgage payments and able to protect the equity in their home by using a bankruptcy exemption. Chapter 13 bankruptcy allows individuals to catch up on their missed monthly mortgage payments by paying back their arrears through a 3-5-year repayment plan. Below, we will discuss in detail how individuals can file bankruptcy to their homes.

What is a Bankruptcy Exemption?

Bankruptcy Exemptions allow individuals who are considering filing bankruptcy a way to keep their property. The government enacted Bankruptcy Exemptions to allow individuals to get rid of their debt and keep a reasonable amount of possessions. Exemptions allow people to keep personal property like clothing, household goods, furnishings, tools, retirement accounts, and electronics.

Individuals who want to keep their property will usually use the Homestead Exemption. The Homestead exemption allows individuals to protect the equity in their primary residence up to a certain dollar amount. In some state’s individuals can also use the Wildcard Exemption to protect their property. The wildcard exemption allows individuals to keep items that don’t fall under another exemption.

Individuals will need to determine if they can use their State's exemptions or the Federal exemptions. To use the state exemption the individual must have resided in the state for at least 730 days (two years) before filing the bankruptcy case. Individuals who haven’t lived in the state for at least the past two years need to use the exemptions of the state where they resided the longest during the past 180 days before filing.

Exemptions are complicated and using the wrong exemptions can be a huge problem for individuals who own property. Individuals that file bankruptcy and use the wrong exemption run the risk of having their property sold to pay off their creditors.

Using Chapter 7 and Chapter 13 to Protect Your Home

The first step in determining if a person can keep their home and file bankruptcy is to see if there is an exemption available to cover the equity in their home. In both Chapter 7 and Chapter 13, individuals can use bankruptcy exemptions to protect the equity in their property. Every state provides different exemptions for individuals to protect their property in bankruptcy. The list of exemptions can be found on each Court's website.

Equity is the value of the property minus the amount that is owed on the property. For example, if a home is worth $500,000 and the value of the home is $450,000 there is $50,000 of equity in the home. Thus, the individual would need to see if they can find an exemption that covers the $50,000 of equity to keep their home.

In a Chapter 7 bankruptcy, if the exemption isn’t enough to cover the equity in an individual’s property, they will need to give up the property. In this case, the Trustee appointed to the individual’s case will sell the property and use the unexempt portion to pay back any creditors. Some states like New York, have recently implemented a loss mitigation program to allow individuals to file Chapter 7 and possibly keep their property. The loss mitigation program allows individuals to apply for a loan modification If they are behind on their mortgage to help them catch up with the arrears. This is jurisdiction-specific and many states have not implemented this program.

In Chapter 13 bankruptcy, the process is different. Individuals who don’t have an exemption available to cover the equity in their home won’t be required to give up their home to repay their creditors. Instead, in a Chapter 13 bankruptcy, the court allows them to pay the non-exempt portion through their Chapter 13 plan. The individual will need to show the Court they can afford to pay their regular monthly mortgage payment including the non-exempt portion. For many, this can get very expensive. For example, if the individual has a home worth $50,000 of equity in the home, but the maximum the individual is allowed to exempt is $20,000, the individual will need to pay back $30,000 through their Chapter 13 plan to keep their home. In addition to these payments, the individual may also have other debts that will be factored into the plan as well.

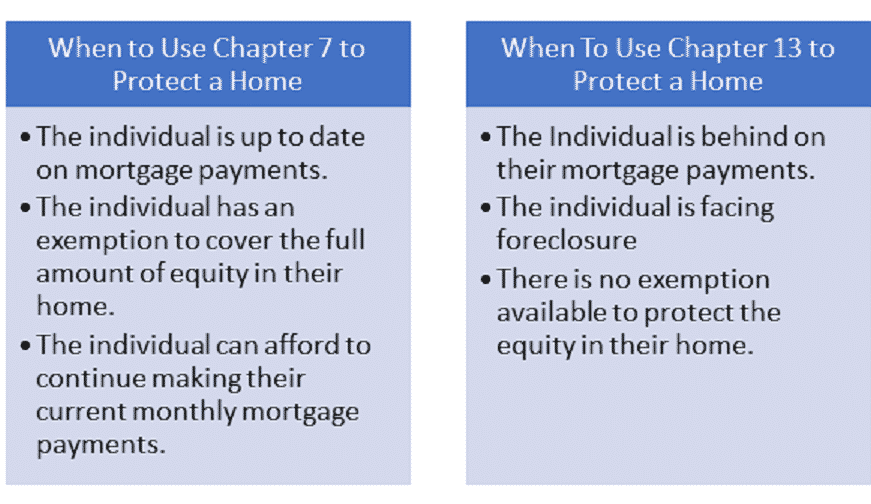

A Chapter 7 bankruptcy can be a better option if the individual can exempt the full equity of their home. The Chapter 7 process is a much quicker and easier process than a Chapter 13 bankruptcy. As long as the individual is up to date on their mortgage payments, has an exemption available to cover all of their mortgage payments, and can continue to afford the monthly mortgage payments the Bankruptcy Court will allow the individual to keep their property. Chapter 7 allows struggling individuals to wipe out their unsecured debt which can give them more disposable income to ensure they stay up to date on their monthly mortgage payments.

Individuals who don’t have an available exemption and are behind on their mortgage payments may want to seek out a Chapter 13 bankruptcy instead. Chapter 13 bankruptcy addresses both issues so the individual can keep their property and still file bankruptcy.

How Can Chapter 13 Help Past Due Mortgage Payments

Individuals who are behind on their mortgage payments won’t be able to use Chapter 7 to help them. Instead, the Chapter 13 process allows individuals time to catch up on their missed payments. After a person files Chapter 13 bankruptcy, they are required to propose a repayment plan to the court. The individual must show the court they can repay their arrears and other debts through the plan while also maintaining their current monthly mortgage payment.

Individuals facing foreclosure can find a great deal of relief by using the Chapter 13 process to save their homes. When a person files bankruptcy an Automatic Stay is initiated which prevents creditors from going after them. The Automatic Stay provides individuals who are worried about the status of their impending foreclosure a sense of relief because they can file bankruptcy and stop the foreclosure proceedings. Individuals can stay in their homes if they keep up with their plan payments.

Getting Legal Advice

If a person can file bankruptcy and keep their home depends on a few factors however, the most important factor is making sure there is an exemption to cover the property. Bankruptcy Exemptions can be complex and confusing to someone who has never seen them before. Using the wrong exemption can put an individual in a bad financial position. It is important to speak with a bankruptcy lawyer if an individual owns property to ensure they file the right chapter of bankruptcy and use the correct exemptions. Not everyone who has property must file a Chapter 13 bankruptcy and vice versa. A bankruptcy lawyer can review an individual’s financials to determine which chapter of bankruptcy is best to ensure their property is safe from creditors.

When to Use Chapter 13 and Chapter 7 To Protect a Home