An individual who owes a debt is probably familiar with “collection notices” from debt collection companies or agencies that are attempting to be paid on past due debt obligations that are delinquent. Many of these debt collection agencies must follow Federal guidelines when trying to collect a debt from a person. The Fair Debt Collection Practices Act or “FDCPA” was enacted in 1977 to limit the actions of third-party debt collectors. The FDCPA defines debt collectors as any party that is trying to collect or attempting to collect debt against another person. This federal statute provides consumers with protections against aggressive debt collectors. Individuals who feel that a debt collector has violated the Federal law can take steps to hold these collection companies responsible under the statue. Some actions individuals can take if they believe that a debt collection agency violated their rights under FDCPA are to sue them in court, report the agency to a government agency such as the Federal Trade Commission (FTC) or Consumer Financial Protection Bureau (CFPB), or report the agency to the attorney general in their state. This article will discuss how the FDCPA works.

To Whom Does the FDCPA Apply

The FDCPA only applies to debt collectors, not the original creditor. Under the Statue a debt collector is defined as a company or individual who “regularly collects debts from others.” For example, if a person owes a debt to a bank, and the bank tries to collect the debt, the FDCPA would not apply. If, on the other hand, the bank sold the debt to a third-party company to collect the debt, then the FDCPA could be enforced.

What is the FDCPA

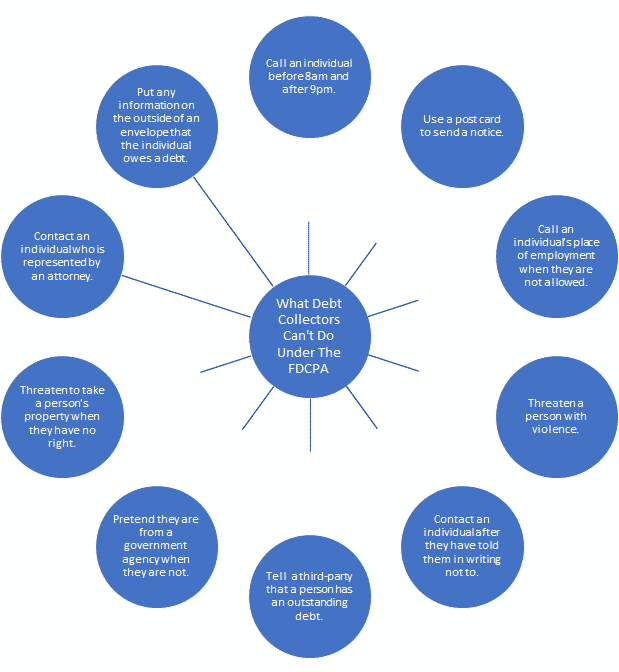

Under the FDCPA collection agencies are required to make certain disclosure before collecting any debt. Moreover, it prohibits debt collectors from engaging in any abusive or deceptive collection practices. Some actions that are prohibited under the FDCPA are:

Generally, under the FDCPA a collection company is not allowed to contact another person about a debt an individual owes. However, there are exceptions to this rule. For example, if the person is an attorney and the debt collector is made aware that the individual is represented by an attorney, they are reporting the outstanding debt to a credit reporting agency, or they are contacting the original creditor about the debt. Further, creditors are permitted to contact an individual’s spouse and parents if the person is a minor. Individuals typically do not want debt collectors calling these third parties or themselves. To stop the collection agencies from doing so, the individual can write a letter asking the debt collector to stop contacting them.

Debt collectors can contact third parties to find the whereabouts of an individual who has an outstanding debt. This is an extremely limited circumstance and debt collectors are under strict obligations to tell the third-party who they are and where they are calling from. Further, they are only allowed to tell them they are contacting them to locate the individual and are not allowed to tell them about the outstanding debt or provide any other information about the individual. Further, these collection agencies are only allowed to contact the third party one time.

When a collection agency calls an individual that has an outstanding debt, they must immediately tell the individual that they are attempting to collect a debt and any information obtained by that person will be used for that purpose. Further, these collection agencies are limited as to when they can call the individual, and where they can call the individual.

Under the FDCPA, a collection agency is not allowed to call a person who has an outstanding debt at an inconvenient time or place. Calls to collect a debt are not allowed before 8 a.m. or after 9 p.m. Further, the debt collector is not allowed to contact the individual at work especially if the debt collection agency knows that the individual’s employer does not allow the individual to receive collection calls at work.

Debt collectors cannot contact anyone who is being represented by an attorney. If an individual has an attorney who is handling the matter, they must ensure that further communications are directed to the attorney.

Lastly, when contacting an individual, the collection agency cannot send any notices about the outstanding debt using a postcard. All notices must be enclosed in a sealed envelope.

Under the FDCPA, a collection agency cannot harass a person because they have an outstanding debt. Harassment includes the use of threats to harm the individual or another person, use violence, or use profane or abusive language. Moreover, a collection agency cannot ruin someone’s reputation because they have an outstanding debt or publish a person's name anywhere.

Individuals who are being harassed by a collection agency should contact authorities or an attorney immediately to ensure these threats are handled properly.

A collection agency is never allowed to lie about who they are. The collection agency cannot pretend that they are with the government or any law enforcement agency when they are not. This means they cannot claim that the individual will go to jail, or all their property will be taken away unless they pay their outstanding debt. Recently, there have been many calls made where individuals are scammed by people overseas who pretend to be the IRS or police attempting to collect a debt. It is important to understand that the IRS will send a notice before trying to collect and they will not call an individual and threaten them over the phone. Further, the collection agency cannot claim that the person committed a crime when in fact, they did not.

Further, a collection agency is not allowed to threaten someone with actions they cannot or will not take. For example, they cannot send a notice saying that this notice is their final notice and the person must respond within 14 days otherwise, they will take legal action and then send another notice. Further, they cannot send a document that looks like it is from an attorney or court when in fact, it is not.

Further, a collection agency cannot falsely report the amount that the individual owes.

A collection agency cannot use any outrageous practices to collect a debt. For example, a collection agency cannot add interest, fees, or charges that are not authorized by law. Moreover, they can’t accept a post-dated check more than five days, they can’t threaten to seize an individual’s property if it has no right to do so, and they cannot identify they are trying to collect a debt on the outside of an envelope when sending mail.

Seek Help

The FDCPA is a statute that provides profound protections for individuals who are drowning in debt. It can stop relentless collection agencies from calling an individual’s work, neighbors, family, and friends. It can also ensure that debt collectors do not threaten people with violence or use any deceptive tactics. Individuals who are struggling to pay their debts and are being harassed by a collection agency should speak with an attorney as soon as possible. Individuals have one year to file a complaint about the illegal debt collection after the violation occurs. The FDCPA provides a range of damages for consumers who pursue FDCPA lawsuits. If an individual wins their case under the FDCPA they may be able to get damages for physical and emotional distress, attorney’s fees, and lost wages. Further, the FDCPA allows consumers to recover damages of up to $1,000 from the collector. An attorney can advise an individual about whether they have a strong claim against a collection company.