Many individuals file Chapter 7 bankruptcy to get out of debt. Individuals and businesses use the Chapter 7 bankruptcy process to eliminate their debt and start over. If the individual or business owns property in the United States or has a permanent residence or business here, they can file a Chapter 7 bankruptcy. The main goal in a Chapter 7 bankruptcy is to get a discharge. A discharge is an order signed by a bankruptcy judge stating that an individual is no longer liable for their debt. For individuals to qualify for a discharge of their debts they must meet certain requirements. Below we will briefly discuss some of the requirements that individuals will need to meet to determine if they are eligible for a Chapter 7 bankruptcy.

The Chapter 7 Means Test

Every individual that files a consumer Chapter 7 bankruptcy must pass a “means test.” The Chapter 7 Means Test determines who qualifies for a Chapter 7 bankruptcy. The Means Test considers an individual’s household income and compares it to the median household income in the State they live in. In some cases, individuals may be exempt from the means test. Disabled veterans and individuals with debts that primarily come from the operation of a business do not need to qualify under the means test. Congress enacted the means test to stop individuals who would otherwise be able to pay their debts back from getting their debts eliminated under a Chapter 7 bankruptcy.

Does the Individual have Disposable Income to Repay their debts?

Bankruptcy laws provide clear rules about who can receive a discharge in a Chapter 7 bankruptcy and who will need to file a Chapter 13 bankruptcy instead. Individuals with higher wages will be forced to pay into a three to five-year Chapter 13 repayment plan. To determine if an individual qualifies for a Chapter 7 bankruptcy, they will need to determine if their current monthly income is below the median household income for a family of the same size in the state they live in. Individuals must average their income over the six months before they file to determine this number. Individuals with less income are eligible to file a Chapter 7 bankruptcy if they meet a few other requirements which we will discuss below. Individuals who have a higher income than the median income in their state will need to go to a second part of the means to determine if they qualify. The second part of the means test considers an individual’s income and expenses to see if they qualify under the means test.

Assets in Bankruptcy

Many individuals who contemplate filing bankruptcy are worried about whether all their assets will be taken away from them. Most individuals can file bankruptcy and keep their assets. Chapter 7 bankruptcy is also called a “liquidation bankruptcy.” When an individual files a Chapter 7 bankruptcy their property becomes part of the bankruptcy estate. Every state has exemptions that allow individuals to keep their assets and eliminate their debts. Individuals who want to keep their assets will need to determine whether they can file for a Chapter 7 bankruptcy without worrying about their assets being liquidated by the bankruptcy trustee.

When Congress enacted bankruptcy exemptions, they allowed individuals to opt into using the state or federal exemptions. Individuals living in states that allow them to use their state exemptions to safeguard property must ensure they have been living in their current state for at least two years before they filed for bankruptcy. Individuals that have not lived in the state for at least 730 days must look at where they spend most of the last 180 days.

Previously Filed Bankruptcy and Received a Discharge

Individuals who have previously filed a Chapter 7 bankruptcy may not be eligible for a bankruptcy discharge. Individuals who obtained a Chapter 7 bankruptcy discharge within the prior eight years are not eligible for a discharge. Moreover, individuals who filed a Chapter 13 bankruptcy and received a discharge within the previous six years are not eligible to file another Chapter 7 bankruptcy and get a discharge.

The Previous Case Was Dismissed

Individuals who previously filed bankruptcy are not eligible to file another Chapter 7 bankruptcy if their Chapter 7 bankruptcy case or Chapter 13 bankruptcy was dismissed within the last 180 days because they violated a court order, the filing was premised on fraudulent circumstances and was an abuse of the bankruptcy process, the individual voluntarily request their case be dismissed after a creditor asked the court for relief from the automatic stay.

Fraud in Bankruptcy

Individuals who qualify for a Chapter 7 bankruptcy under the Means Test run the risk of getting their case dismissed if the Court believes the individual tried to defraud their creditors. Those transfer assets out of their name or fail to disclose assets on their bankruptcy, so they do not have to give the assets up to pay their creditors run the risk of having their case dismissed. The look-back period for transferring property to an “insider” meaning a friend, or family for less than fair market value if one year. The Trustee will look closely at whether the individually sold their assets to friends or family for less than fair market value, charged luxury items on credit cards right before filing bankruptcy knowing there was no way of paying the items back, hiding property or assets from a business partner, lying about income or debts on the bankruptcy petition.

Every individual that files a bankruptcy petition must certify that everything in their petition is true and correct. Individuals that fail to disclose their assets or omit information can run the risk of being prosecuted for fraud. Bankruptcy fraud is a federal crime that could lead to jail time.

Qualifying Businesses’ in Bankruptcy

Some businesses can use the Chapter 7 bankruptcy process to eliminate their debt. Sometimes individuals that own a business can file Chapter 7 bankruptcy to eliminate their liability. Usually, it does not make sense for a Corporation or an LLC to file bankruptcy under Chapter 7. Generally, corporations and LLCs that file Chapter 7 bankruptcy are not able to get a discharge and eliminate their debt. Most large businesses that file Chapter 7 bankruptcy use the process to liquidate their assets and use the funds to pay off creditors.

Sole proprietors and small businesses’ that have assets with little value are often able to use the Chapter 7 bankruptcy process to eliminate their debt. Small business owners that are considering filing a Chapter 7 bankruptcy must determine whether their business is worth anything that the trustee would want to sell or whether they have assets the trustee will want to liquidate.

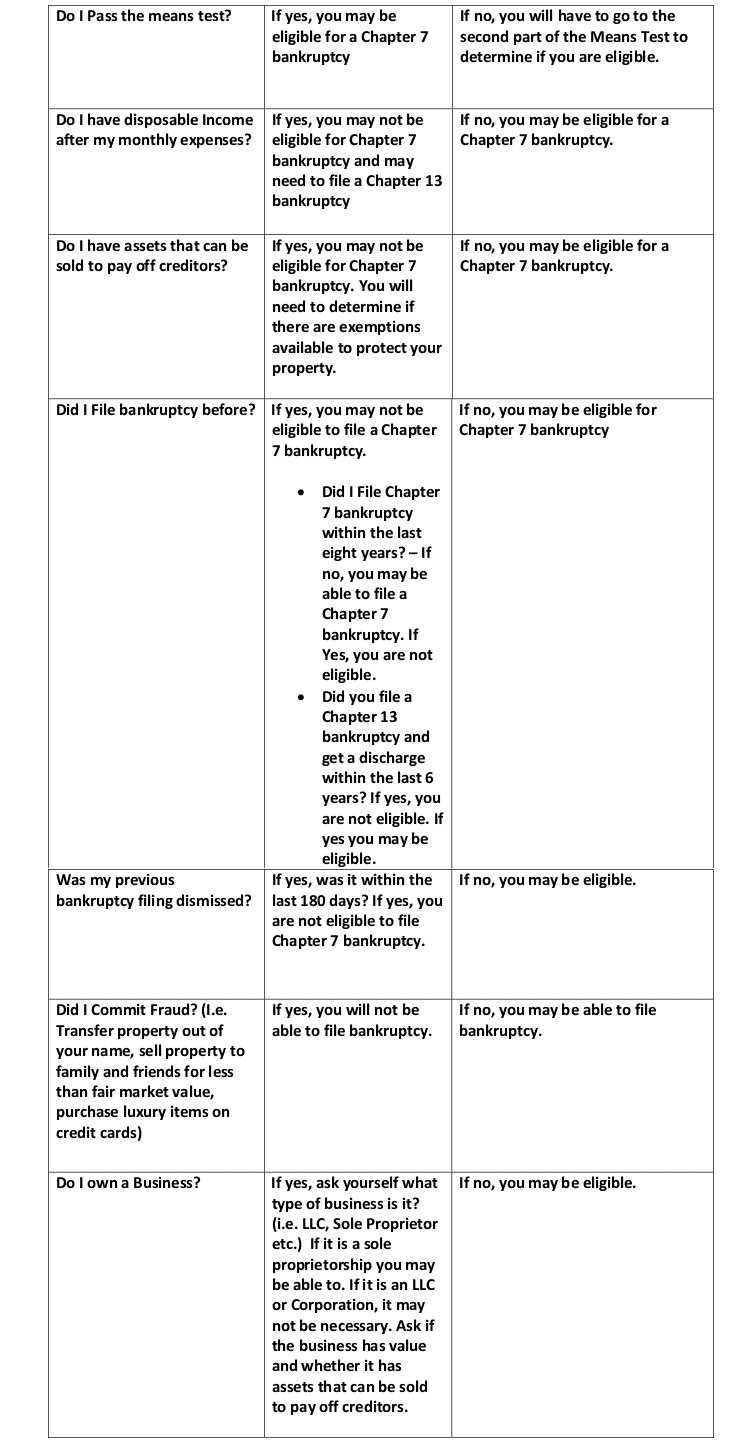

Questions to ask yourself to Determine if You are Eligible for filing Bankruptcy

Speaking with a Bankruptcy Lawyer

Speaking with a Bankruptcy Lawyer

The best way for individuals to determine if they qualify for a Chapter 7 bankruptcy is to meet with a bankruptcy lawyer who can review the individual’s financial circumstances. A bankruptcy lawyer can go over the individual’s financial history and determine if they would be eligible for a Chapter 7 bankruptcy. Many lawyers provide free consultations that individuals looking to file bankruptcy should take advantage of. Bankruptcy lawyers can review whether an individual has committed fraud in the eyes of the bankruptcy court, review the exemptions to ensure the individual's property is safeguarded, and review the bankruptcy code to ensure the individual falls within the necessary criteria to file a Chapter 7 bankruptcy.