Individuals who are currently in a Chapter 13 bankruptcy, may find that they need to convert their bankruptcy case to a Chapter 7. Individuals often need to convert because they cannot afford their plan payments in their Chapter 13 reorganization plan any longer or they simply filed their case to keep property which they no longer want to keep.

In some cases, the Bankruptcy Court may even force an individual to convert their bankruptcy case from a Chapter 13 bankruptcy to a Chapter 7. However, this is rare and usually unlikely to happen. The Court will order a conversion if they believe that an individual filed their Chapter 13 in bad faith. For instance, if the individual’s actions suggest that they were trying to manipulate the bankruptcy process by filing to stop a foreclosure sale with no real intention to pay back their lender.

If the individual is doing everything, they can show the Court they are trying to pay back their creditors then they will not have to worry about the Bankruptcy Court converting the case. Thus, even if the individual misses a payment or two because they lost their job, or some unforeseen circumstance has arisen, it is unlikely the bankruptcy court will force a conversion. Typically, when a person misses a payment in their Chapter 13 bankruptcy, the court will dismiss their case instead of forcing a conversion.

How to Qualify for Conversion

Most individuals who file Chapter 13 have the right to convert their Chapter 13 case to a Chapter 7. However, this does not automatically mean that the individual will qualify for a Chapter 7 discharge. Individuals who wish to convert their case, will first need to make sure they are eligible for a Chapter 7 bankruptcy.

The first step in determining whether the individual is eligible for a Chapter 7 bankruptcy is by determining if they pass the Means Test. The Means Test takes an individual’s income and expenses and determines whether a person has the financial ability to pay back their debts. Congress enacted the Means Test to prevent people who could otherwise afford to pay back their creditors, from filing bankruptcy and not paying back their debts. Individuals who are below their state’s median income automatically qualify for a Chapter 7 bankruptcy. Individuals who do not pass the means test initially will need to move on to the second part of the test. If the individual still does not qualify, they will not be able to file a Chapter 7 bankruptcy.

Many people enter Chapter 13 bankruptcies because they do not pass the Means Test initially and are not eligible for a Chapter 7. Individuals, however, may find themselves able to pass the Means Test if their financial circumstances change. For example, individuals who lose their job or have a medical issue arise during their Chapter 13 forcing them to work less may be able to pass the Means Test now even though they couldn’t when they initially filed their Chapter 13 case.

Not all states, however, agree that when a case is converted the individual must pass the Means Test. However, all courts believe that allowing people to skip over the means test by filing Chapter 13 first and then converting to Chapter 7 would allow a loophole in the system. This would essentially allow high-income wage earners to avoid paying back their creditors by filing a Chapter 13 first and then converting their case. So, the bankruptcy court implemented a law to prevent this from happening. If an individual tries to convert their case the bankruptcy trustee and creditors can show the Bankruptcy Court that the individual has enough income after their monthly expenses to pay back their creditors and thus, should not be allowed to convert their case.

Qualifying for a Discharge in a Chapter 7 Case

The end goal in a Chapter 7 bankruptcy is to get a discharge so that individuals are not required to repay their debts. A discharge is a court order which advises the debtor and their creditors that their debt is eliminated, and they are no longer liable for the debts.

Many individuals may qualify and proceed with a Chapter 7 bankruptcy case but are not eligible for a discharge. Just because someone passes the Means Test and can convert their case does not necessarily mean that the Bankruptcy Court will issue them a discharge.

Individuals can be denied a discharge for various reasons. The most obvious reason why an individual may not be eligible for a discharge is if they received a Chapter 7 discharge within the previous eight years. An individual however, may still decide to convert their case even though they are not eligible for a discharge. Typically, this happens when an individual has property they no longer want. When this happens, the bankruptcy trustee can sell any property that is nonexempt or protected by a bankruptcy exemption and use the money from the sale of the property to pay off some or all the individual’s creditors. This can be beneficial for someone who has many creditors because once their case ends, they will not have to pay back their creditors as much money.

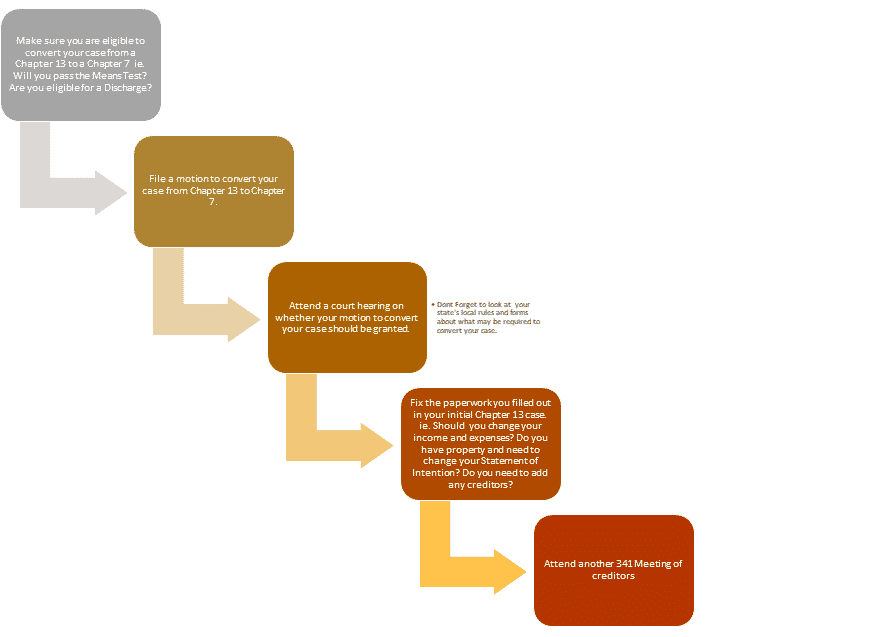

Steps for Conversion

If an individual determines they want to convert their Chapter 13 case to Chapter 7, they will need to begin the process by filing a Motion to Convert. The motion to Convert asks the court permission to allow the conversion. The motion will need to be sent to the individual’s creditors and any other interested party. Typically, the individual will need to attend a court hearing on the motion however, some courts may allow the request without a hearing if no one objects to the conversion.

Most of the bankruptcy forms that were filed in the individual’s Chapter 13 bankruptcy case can be transferred to the individual’s Chapter 7 case. Most filer’s however will need to update these forms. For example, if the individual’s financial circumstances have changed, they will need to update their income and expenses on their bankruptcy petition. Further, individuals with property who wish to surrender or give up their property will need to make changes to their “Statement of Intention.” The Statement of Intention gives the Court and the individual’s creditors notice about what they plan to do with the property.

All proof of claims submitted by creditors in the individual’s Chapter 13 case will automatically transfer to the Chapter 7 case. Creditors will typically be given a new opportunity to resubmit their claims. Individuals who acquired new debt since they started their Chapter 13 case will be allowed to include those creditors in their Chapter 13 case.

Further, the individual’s exemptions will be determined as of the date the individual filed their Chapter 13 bankruptcy case. If the individual acquired any property after the initial Chapter 13 filing, creditors will not be able to take it.

Once the individual submits all their required paperwork to the court, they will need to attend a 341 Meeting of Creditors’. This is a requirement even if they already attended this hearing within their Chapter 13 bankruptcy case.

Conclusion

Individuals who want to convert their case from a Chapter 7 bankruptcy to a Chapter 13 bankruptcy, will need to check their local rules. Many states provide additional rules that individuals must follow to get their Chapter 13 case converted.

Individuals who are not sure whether converting their case makes sense should speak with a bankruptcy lawyer who can help them make an informed decision as to such.

How to Convert a Chapter 13 Bankruptcy to a Chapter 7 Bankruptcy